Unveiling the Interplay Between Social Media Discourse and Financial Market Dynamics: A Deep Dive into the Turkish E-commerce Sector

The digital age has ushered in an era of unprecedented interconnectedness, where social media platforms serve as vibrant hubs for public discourse, shaping opinions and influencing behaviors across various spheres of life. This study delves into the complex relationship between social media conversations and financial market dynamics, focusing specifically on the Turkish e-commerce sector during the tumultuous period of the COVID-19 pandemic. By analyzing a multi-layered network of nine prominent e-commerce companies listed on the Borsa Istanbul Stock Exchange (BIST) and correlating their financial performance with social media sentiment across six key topics – culture, economy, health, politics, technology, and world affairs – this research seeks to uncover the extent to which online discussions translate into tangible market impacts.

Methodology and Data Acquisition: A Multifaceted Approach

The study employs a rigorous methodology combining financial data analysis, social media sentiment extraction, and advanced statistical modeling. Financial data, including daily closing prices, highs, lows, and trading volumes of the selected companies, was used to construct a four-layered network representing different aspects of market performance. Social media data, comprising Turkish tweets related to COVID-19, was collected and categorized based on the six predefined topics. A deep learning model trained on a dataset of Turkish news articles was utilized to classify the tweets, ensuring accurate topic assignment. Finally, a Non-linear Autoregressive Distributed Lag (NARDL) model was employed to investigate the complex relationships between social media discourse and financial market indicators, accounting for both short-term and long-term effects.

Multiplex Analysis: Deciphering the Network Dynamics

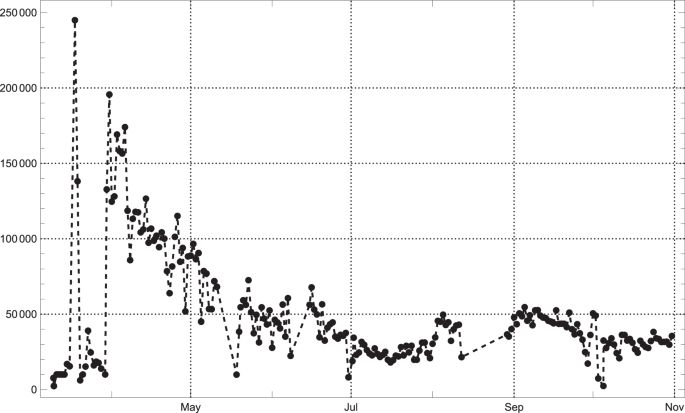

The analysis of the multi-layered network revealed intriguing insights into the interconnectedness and behavior of the selected e-commerce companies. The mean multilayer participation coefficient, a measure of how integrated a company is within the network, fluctuated significantly over the study period, suggesting periods of high interconnectedness interspersed with periods of fragmentation. Similarly, the mean z-score, indicating a company’s deviation from the network average, exhibited periodic spikes, highlighting instances of atypical market behavior. The multilayer entropy, reflecting the complexity of the network, generally remained high, indicating a diverse and interconnected market influenced by multiple factors. These findings underscore the dynamic nature of the e-commerce sector and its susceptibility to external influences.

Topic Classification and NARDL Analysis: Unraveling the Influence of Social Media

The NARDL analysis, focusing on the relationship between social media discourse and two key market indicators – mean multilayer participation coefficient and multilayer entropy – yielded mixed results. While some topics, such as economy and technology, showed signs of influencing market dynamics, others, like culture and health, exhibited weaker or non-significant relationships. The analysis revealed that the impact of social media sentiment varied both in direction and magnitude depending on the topic and the specific market indicator being considered. Notably, the long-run asymmetry tests suggested that positive and negative changes in social media discourse could have different long-term effects on market behavior, highlighting the importance of considering sentiment polarity in such analyses.

Key Findings and Implications: Navigating the Digital Landscape

The study’s findings provide valuable insights into the complex interplay between social media discourse and financial market dynamics in the digital age. While the impact of social media sentiment varied across different topics, the research highlights the potential for online conversations to influence market behavior, particularly in sectors like e-commerce that are heavily reliant on public perception and online engagement. The study emphasizes the importance of monitoring social media trends and sentiment as valuable indicators of market dynamics and potential investment opportunities.

Limitations and Future Research Directions: Refining the Lens

Despite its contributions, this study acknowledges certain limitations. The focus on broad topics limited the ability to analyze specific themes or events that might have a more direct impact on financial markets. Future research could benefit from a more granular analysis of specific themes within each topic, such as economic policy discussions within the economy topic or specific technological advancements within the technology topic. Additionally, the study’s reliance on Twitter data might not fully capture the nuances of social media discourse across different platforms. Incorporating data from other social media platforms and expanding the scope of analysis to include other financial markets and geographical regions could further enhance the generalizability of the findings.

Conclusion: Embracing the Complexity

The intricate relationship between social media discourse and financial market dynamics presents both opportunities and challenges for businesses, investors, and regulators. By understanding the nuances of this interplay, stakeholders can leverage the power of social media to gain valuable insights into market sentiment, identify emerging trends, and make more informed decisions in the increasingly complex digital landscape. This study serves as a crucial step towards unraveling this complexity, paving the way for future research that can further illuminate the intricate relationship between online conversations and the world of finance.